BUREAU OF INSURANCE CLAIMS ASSISTANCE

We are a firm of licensed and bonded public adjusters dedicated to standing up for policyholders when it matters most. We represent you — not the insurance companies — to ensure you receive the full and fair compensation you’re entitled to after experiencing property damage or loss. With years of experience navigating complex insurance policies, we’ve built a reputation for excellence, transparency, and results. Whether you’re facing an aftermath of a fire, plumbing leak, storm, hurricane, or other property-related event, our team steps in to take the burden off your shoulders. We understand how overwhelming the claims process can be. That’s why we handle every aspect of your claim: from inspecting the damage and documenting evidence, to negotiating directly with your insurer.

Our mission es to advocate for you, protect your rights, and maximize your payout.

Plumbing Leak Damage Claims

Water damage from leaking pipes can quickly escalate into costly repairs. We help homeowners and businesses file strong claims for damages caused by burst pipes, hidden leaks, and plumbing failures — ensuring you receive the full compensation your policy allows.

Sewage Backup Claims

A sewage or drain backup isn’t just unpleasant — it can be a serious health hazard. Our team documents the damage, negotiates with your insurance provider, and fights for a proper settlement to restore your property safely and thoroughly.

Fire and Smoke Damage Claims

Fires can leave lasting structural, smoke, and soot damage. We represent your interests, from assessing total loss to handling complex fire-related claim documentation, so you can focus on rebuilding while we secure your maximum payout.

Hurricane & Storm Damage Claims

When a hurricane hits, insurance companies often try to minimize payouts. We make sure your wind, water, and structural damages are fully documented and compensated — guiding you through the entire process quickly and professionally.

Hail Damage Claims

Hailstorms can damage roofs, siding, windows, and more. Even minor-looking damage can lead to major issues later. Our adjusters inspect, document, and negotiate on your behalf to ensure you receive the full value of your hail claim.

Roof Leak Damage Claims

Roof leaks can lead to mold, rot, and structural damage over time. Whether caused by storms, wear, or construction defects, we help file and manage your claim to get the repairs covered quickly and completely.

Commercial claims

We have extensive experience handling all types of property claims for commercial clients: restaurants, hotels, hair salons, auto repair shops, etc.

Flood Claims

We are NFIP-compliant and have specific expertise needed to handle and negotiate flood claims. These are usually adjusted and handled differently from regular homeowners’ claims, and we have the experience to navigate them on your behalf.

Mold Claims

If you see or suspect having mold inside your home, we can help in getting you paid to have it properly and safely remediated.

Why Choose Bureau of Insurance Claims Assitance.

Proven Expertise

With years of experience in public adjusting, we know how to maximize your claim and fight for what you rightfully deserve.

Transparent Process

From inspection to settlement, we keep you informed every step of the way. No hidden fees or surprises—just honest, dependable service.

Multilingual Support

We offer services in English, Spanish, and Russian to ensure clear communication and understanding throughout your claim process.

Real Results

Our case studies speak for themselves—showcasing actual checks and property damage before and after we stepped in. We don’t just promise results; we deliver them.

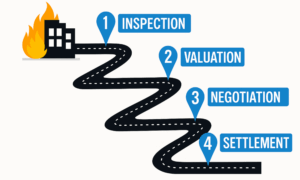

How We Operate

Inspection

Wough on-site inspection of your property to assess all visible and hidden damages.

Valuation

Next, we evaluate the full extent of the damage and calculate a fair estimate of the loss, based on policy coverage and market rates.

Negotiation

We handle all communication and negotiations with the insurance company, ensuring your claim is not undervalued or delayed.

Settlement

Once we reach a fair agreement, you receive your full settlement — often significantly more than the initial offer.

Who are Public Adjusters and what do they do?

We are licensed and experienced property claim adjusters working for you, and not for the insurance company. We make sure your insurance claim will be covered and paid in full. We also can advise you – before the claim is even filed – whether your claim is worth filing the first place: will the claim be covered by your policy, and whether the payment amount you may receive will be large enough to warrant filing a claim. We can also review your policy to make sure it’s optimized, protects your property well and that you are not paying for something you don’t actually need. The initial inspection and the services mentioned above are completely FREE for you! Further, we handle for you all the hassle and aggravation of communicating with the insurance company.

Who are Public Adjusters and what do they do?

We are licensed and experienced property claim adjusters working for you, and not for the insurance company. We make sure your insurance claim will be covered and paid in full. We also can advise you – before the claim is even filed – whether your claim is worth filing the first place: will the claim be covered by your policy, and whether the payment amount you may receive will be large enough to warrant filing a claim. We can also review your policy to make sure it’s optimized, protects your property well and that you are not paying for something you don’t actually need. The initial inspection and the services mentioned above are completely FREE for you! Further, we handle for you all the hassle and aggravation of communicating with the insurance company.

Who are Public Adjusters and what do they do?

We are licensed and experienced property claim adjusters working for you, and not for the insurance company. We make sure your insurance claim will be covered and paid in full. We also can advise you – before the claim is even filed – whether your claim is worth filing the first place: will the claim be covered by your policy, and whether the payment amount you may receive will be large enough to warrant filing a claim. We can also review your policy to make sure it’s optimized, protects your property well and that you are not paying for something you don’t actually need. The initial inspection and the services mentioned above are completely FREE for you! Further, we handle for you all the hassle and aggravation of communicating with the insurance company.

Why do I need to hire a Public Adjuster to advocate on my behalf?

While there are many insurance companies’ adjusters who are earnest and sincerely want to help the policyholders, the insurance companies’ internal guidelines and culture encourage adjusters to underpay claims and to try to find ways to deny claims altogether. Having a Public Adjuster on your side will guarantee that your rights will be protected, that your claim will be covered and paid fairly. Show your insurance company that you mean business – hire us to represent you!

Why do I need a Public Adjuster? My contractor said he can negotiate on my behalf.

Firstly, insurance companies are in no way obligated to negotiate with contractors, and often refuse to do that. Secondly, contractors rarely understand nuances in the policies, state statutes and case law that direct the insurance companies how they should pay claims. Thirdly, the contractors oftentimes are not skilled in creating itemized estimates using the insurance industry’s databases and software that are crucial in justifying the amount of the claim. And fourthly, the contractor will know precisely how much and when you get paid; if you hire a Public Adjuster, you don’t need to disclose to any contractor you may hire how much you got paid and for what.

How do Public Adjusters get paid?

We charge a small percentage fee of the claim after it is paid with our help. You pay $0 up front, only after you get the claim check. We completely guarantee your claim will be paid, and you have no financial risk in hiring us.

Should I file the claim myself, and call you sometime afterwards?

While we can reopen and appeal your claim to address any underpayment, your claim will be paid better and quicker if you allow us to file the claim and handle the process from the beginning. The way the claim is presented initially is critical, and the insurance company will likely use any missing or misinterpreted information to deny of the claim, resulting for you in an often lengthy and complicated appeal process.

Get Claim Assistance

Florida office - Miami, FL

Texas office - Houston, TX

Contact Us

Have questions about your claim? Need help understanding your insurance coverage? We’re here to help every step of the way. Reach out to Bureau of Insurance Claims Assistance today for a free consultation or to schedule your property inspection.

FLORIDA OFFICE:

145 SW 13th St, #301, Miami, FL 33130

786-315-7503

BICA.FL@gmail.com

TEXAS OFFICE:

1515 Paige St, Houston, TX 77003

832-670-9244

Houston.BICA@gmail.com